A new health plan for your family can feel like navigating a maze. Different terms, changing benefits, and new costs can leave you wondering how it will truly impact your loved ones’ healthcare. But understanding these changes is crucial to ensuring your family receives the care they need without unexpected financial burdens. Think of this as your personal guide to decoding the complexities and making informed decisions for your family’s well-being under the new plan.

Whether it’s a plan offered by your employer, a government marketplace, or a private insurer, staying informed is your first and most important step. This article will break down the potential impacts of a new health plan on your family, highlighting what to look for and how to leverage your benefits effectively.

Understanding the Core Changes in Your New Health Plan

When a new health plan is introduced, several key areas are likely to see changes. These changes directly influence your family’s access to care and your out-of-pocket expenses.

Premiums: What Will You Pay Each Month?

The most immediate change you’ll likely notice is the premium – the fixed amount you pay monthly to have health insurance coverage. Under a new health plan for your family, premiums could increase, decrease, or stay relatively similar, depending on the plan’s overall structure and benefits.

- Actionable Takeaway: Compare the new premium to your previous one. Understand if the change in cost aligns with the changes in coverage or benefits.

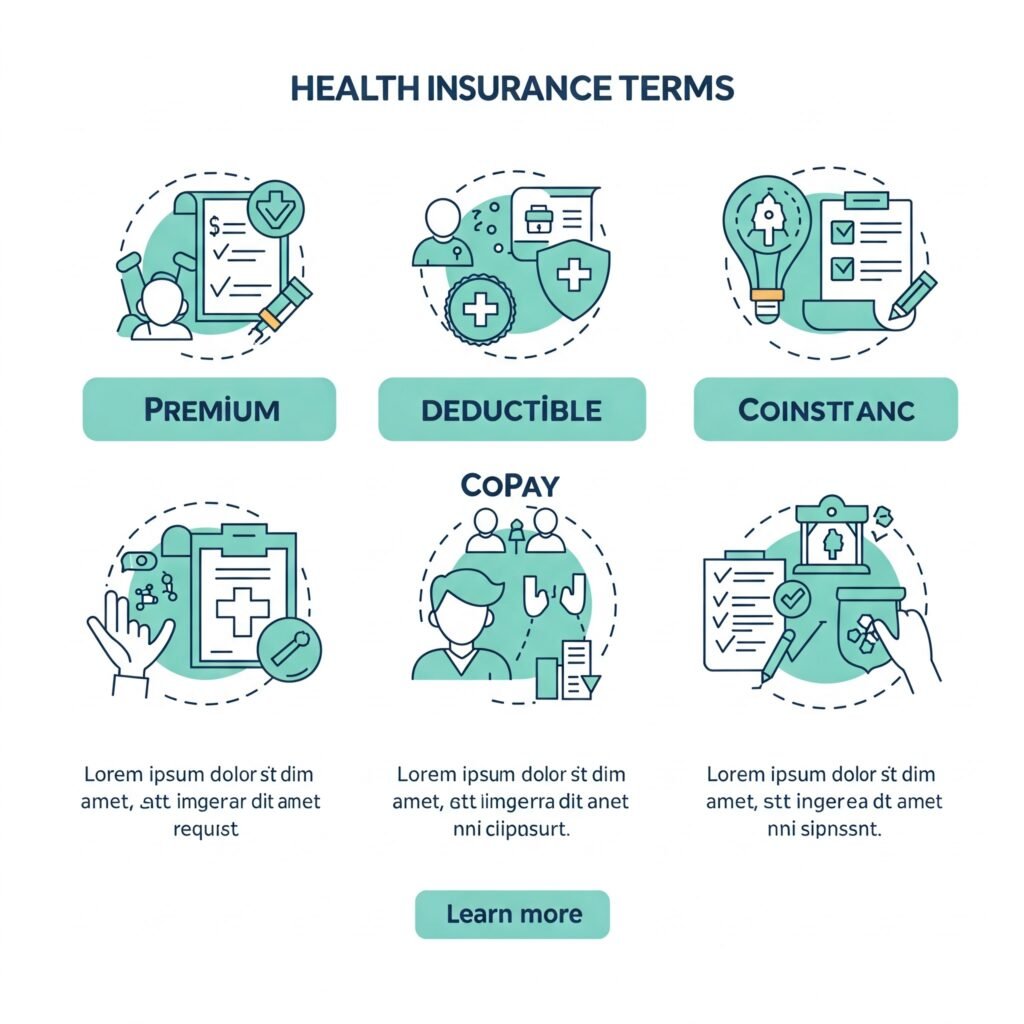

Deductibles, Copays, and Coinsurance: Your Out-of-Pocket Costs

These three terms are crucial for understanding how much you’ll pay when your family members receive medical care.

- Deductible: The amount you pay out-of-pocket before your insurance plan starts to pay. Has your family deductible changed? A higher deductible might mean lower monthly premiums but higher costs when you need care.

- Copay: A fixed amount you pay for a covered healthcare service after you’ve met your deductible (though some services may have copays before the deductible is met). Are copays for doctor visits, specialist visits, or prescriptions changing under the new health plan?

- Coinsurance: Your share of the costs of a covered healthcare service, calculated as a percentage (for example, 20%) of the allowed amount for the service. This applies after you’ve met your deductible. How does the coinsurance percentage in the new health plan compare to your old one?

These cost-sharing elements directly impact how much you’ll pay for everything from a routine check-up to a hospital stay for a family member.

- Actionable Takeaway: Analyze how the new deductible, copays, and coinsurance structure will affect your family’s typical healthcare usage. If your family has frequent medical needs, lower cost-sharing might be more beneficial, even with a higher premium.

How the New Health Plan Impacts Your Family’s Access to Care

Beyond the costs, a new health plan for your family can also change which doctors, hospitals, and specialists you can visit.

Provider Network: Are Your Family’s Doctors Included?

Health plans have networks of healthcare providers they contract with. Visiting providers outside this network can result in significantly higher costs.

- Actionable Takeaway: Check if your family’s current doctors, pediatricians, specialists, and preferred hospitals are “in-network” with the new health plan. Don’t assume – verify directly with the insurance provider and your healthcare providers.

(Outbound Link Suggestion: Link to a reputable source explaining how to check if a healthcare provider is in-network.)

Prescription Drug Coverage: Will Your Family’s Medications Still Be Covered?

Formularies (lists of covered prescription drugs) can change with a new health plan. The cost of your family’s medications might also change depending on the plan’s tier system for drugs.

- Actionable Takeaway: Review the new plan’s formulary to ensure all essential medications for your family members are covered. Check the cost tier for each medication to understand your potential out-of-pocket expense.

New Health Benefits for Your Family to Explore

While changes can involve increased costs or network adjustments, a new health plan might also introduce valuable new benefits for your family.

Expanded Preventive Care Services

Many new plans emphasize preventive care, which can include free annual check-ups, immunizations, and health screenings.

- Actionable Takeaway: Take advantage of the preventive care benefits offered by the new health plan to keep your family healthy and potentially catch issues early.

Enhanced Mental Health Coverage

With a growing understanding of the importance of mental well-being, some new health plans offer improved coverage for mental health services, including therapy and counseling.

- Actionable Takeaway: Explore the mental health benefits available and understand how your family can access these services if needed.

Telemedicine and Virtual Care Options

Many recent health plans have expanded their coverage for telemedicine, allowing your family to consult with healthcare providers remotely.

- Actionaway Takeaway: Understand how to access telemedicine services through your new health plan for convenient and potentially lower-cost consultations for minor ailments.

Making the Best Choices for Your Family Under the New Health Plan

Navigating a new health plan for your family requires proactive steps. Here’s how to make the most of your coverage:

Review the Summary of Benefits and Coverage (SBC)

This standardized document provides a clear overview of what the new health plan covers and what your costs will be.

- Actionable Takeaway: Read the SBC carefully, paying close attention to deductibles, copays, coinsurance, and out-of-pocket maximums.

Calculate Your Potential Out-of-Pocket Maximum

The out-of-pocket maximum is the most you’ll have to pay for covered healthcare services in a plan year. Knowing this limit can help you budget for potential medical expenses.

- Actionable Takeaway: Understand the out-of-pocket maximum for your family under the new health plan and factor it into your financial planning.

Utilize Open Enrollment Wisely

If you are selecting a new health plan for your family during an open enrollment period, take the time to compare all available options. Consider your family’s health history, anticipated medical needs, and budget.

- Actionable Takeaway: Don’t just renew your old plan without reviewing the new options available, especially if a new health plan is being introduced.

Real-World Examples and Data

Consider the Johnson family. Under their old plan, they had a low monthly premium but a high deductible. When their daughter broke her arm, they faced significant out-of-pocket costs before their insurance kicked in. Their new health plan has a slightly higher premium but a much lower deductible and lower copays for specialist visits. While their monthly cost increased slightly, the financial impact of their daughter’s injury would have been significantly less under the new structure.

Data consistently shows that families who actively engage with their health plans and understand their benefits are better equipped to manage healthcare costs and access appropriate care.

Conclusion: Taking Charge of Your Family’s Healthcare

A new health plan for your family presents an opportunity to re-evaluate your healthcare needs and make informed decisions. By understanding the potential changes in premiums, cost-sharing, provider networks, and benefits, you can navigate the new landscape with confidence.

Take the time to review your plan documents, verify provider networks, and understand your prescription coverage. Leverage the preventive care and other new benefits offered. By being proactive, you can ensure your new health plan for your family provides the best possible coverage and support for their health and well-being.